interest tax shield formula

The formula for the attrition. On the income statement interest expense will increase by 10 which causes net income to decrease by 7 given a 30 tax rate assumption.

Tax Shield Formula Step By Step Calculation With Examples

Bank Reconciliation Formula Example 1.

. Tax Multiplier MPC 1 MPC 1 MPT MPI MPG MPM where. If a company has incurred 10 in PIK interest how are the three financial statements impacted. Here is the formula to calculate interest on the income statement.

Risk Free Rate Formula. VIP Industries Ltd has taken a Long-term borrowing of INR 1500000 with an interest rate of 10 per annum from Yes Bank. On the cash flow statement net income will be down by 7 but the 10 non-cash PIK interest is added.

Simple Interest INR 1330000 Therefore the total amount paid by ABC Ltd to the lender is INR 1330000. The term real interest rate refers to the interest rate that has been adjusted by removing the effect of inflation from the nominal interest rateIn other words it is effectively the actual cost of debt for the borrower or actual yield for the lender. Thus there is a tax savings referred to as the tax shield.

However in case the change in tax affects all the components of the GDP then the complex tax multiplier formula has to be used as shown below. The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. The interest expense reduces the taxable income earnings before taxes or EBT of a company.

Interest Tax Shield Example. Simple Interest Formula Example 3. Attrition Rate 65 Therefore the firms attrition rate for the year 2018 was 65.

Imagine getting a bunch of tax documents telling you and the IRS about a large sum of money you made when in fact you never received a penny of it. The reason why the pre-tax cost of debt must be tax-affected is due to the fact that interest is tax-deductible which effectively creates a tax shield ie. Interest Coverage Ratio ICR EBIT Interest Expense.

Firstly determine the outstanding loan amount extended to the borrower denoted by P Step 2. Jefferson earned the annual interest rate of 481 which is not a bad rate of return. Rental price 70 per night.

To calculate compound interest you first need to know. Following are the steps to calculate Simple Interest. Compound interest is a method of earning interest on your invested money.

Interest Tax Shield Interest Expense Tax Rate. From the following particulars prepare Bank Reconciliation statement for Ms XYZ and company as at 31 st December 2018. Real Interest Rate Formula Table of Contents Formula.

Attrition Rate 20 310. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. This is the regular interest payments by a company.

σ2 Xi μ2 N. For Profit vs Non Profit. I P R T.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest Deduction As Mortgage Interest Mortgage interest deduction refers to the decrease in taxable income allowed to the homeowners for their interest on a home loan taken for purchase or construction of the house or any borrowings. In this article we have primarily discussed the simple tax multiplier where the change in taxes only impacts consumption.

The number of times your interest gets compounded per year 4. Future Value of an Annuity Formula. The course is included in the specialization program and will be released in.

2 or higher Interest Coverage ratio is generally considered for good capacity. Where Xi ith data point in the data set μ Population mean N Number of data points in the population Examples of Variance Formula With Excel Template Lets take an example to understand the calculation of the Variance in a better manner. Depreciation Tax Shield is the tax saved resulting from the deduction of depreciation expense from the taxable income and can be calculated by multiplying the tax rate with the depreciation expense.

For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of. The effect of a tax shield can be determined using a formula. Your principal investment amount 2.

I 100000 7 125. This is usually the deduction multiplied by the tax rate. Annualized Rate of Return Formula.

Debt Service Coverage. Compound Interest Formula Steps to Calculate Compound Interest. 10481 1 r.

It can be calculated using the below formula. All future courses are included in the purchase of the specialization. The formula for calculating the interest tax shield is as follows.

GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. Next determine the tenure of the loan or the period for which the loan has been extended. Compound interest is the product of the initial principal amount by one plus the annual interest rate raised to the number of compounded periods minus one.

Companies using accelerated depreciation methods higher depreciation in initial years are able to save more taxes due to higher value of tax shield. The best opinions comments and analysis from The Telegraph. Tax Shield Deduction x Tax Rate.

To learn more launch our free accounting and finance courses. Next determine the interest rate to be paid by the borrower which is denoted by r. Interest Expense Formula.

The values are applied in the below to get the Interest coverage ratios calculated. The rate of interest your investor offers 3. See My Options Sign Up.

What is the Real Interest Rate Formula. Balance as per Bank Book is 8000. Interest Tax Shield Formula.

I Rs8750 So the interest earned by an investor on the redeemable bond is Rs8750. If a company has zero debt and EBT of 1 million with a tax rate of 30 their taxes payable will be 300000. AfterTax Cost of Debt Formula.

Interest Rate Formula is helpful in knowing the Interest obligation of the borrower for the loan undertaken and it also helps the lender like financial institutions and banks to calculate the net interest income earned for the assistance.

Tax Shield Formula How To Calculate Tax Shield With Example

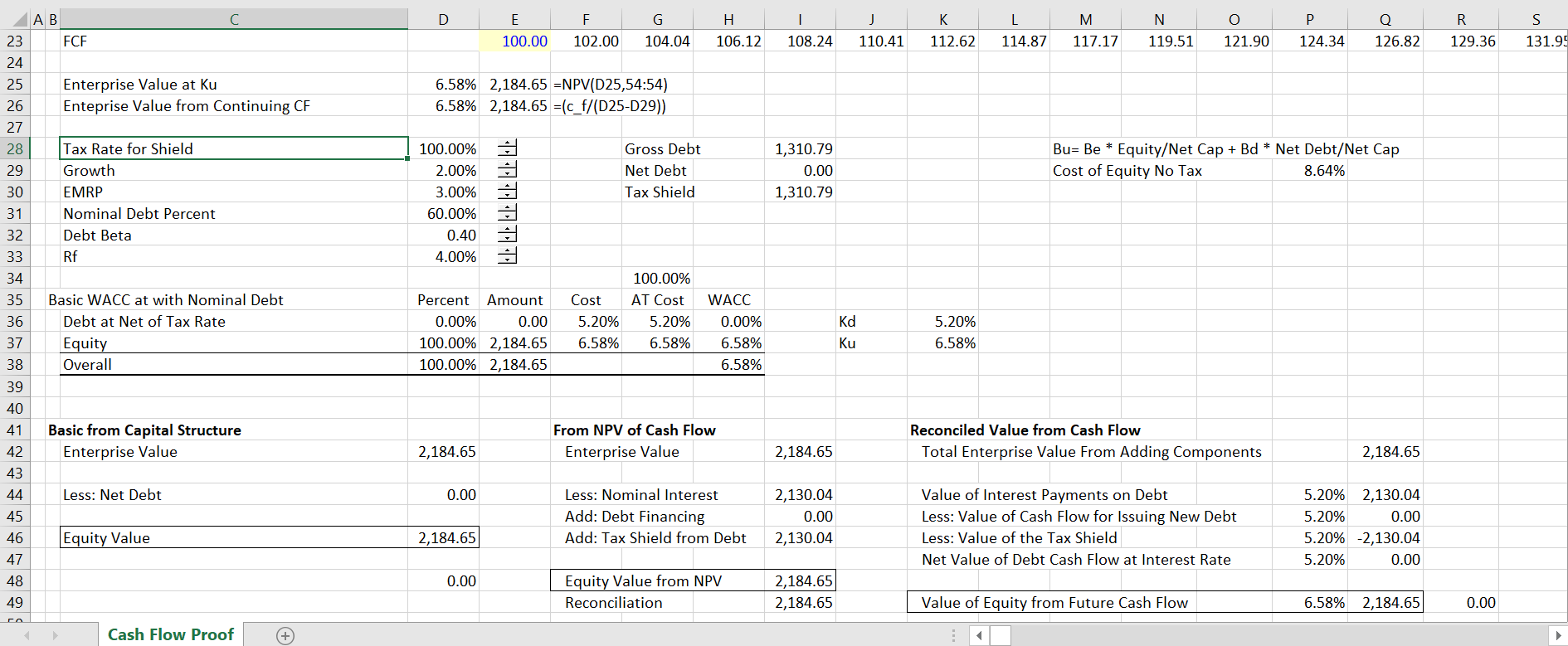

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Interest Tax Shield Formula And Calculator Excel Template

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Meaning Importance Calculation And More

Tax Shields Financial Expenses And Losses Carried Forward

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Modigliani And Miller Part 2 Youtube

Tax Shield Formula How To Calculate Tax Shield With Example